In the world of e-commerce marketing, you often hear about ARPU and LTV metrics, which are sometimes mistakenly used as synonyms. However, for those who are looking to scale their e-commerce business and increase website conversion, it is important to understand that these are two completely different metrics, each of which answers its own unique questions.

What is ARPU?

ARPU (Average Revenue per User) is an indicator of the average revenue generated by one active user over a certain period. This metric is used when you need to evaluate online sales for businesses, including online stores and B2B marketing through digital, to understand the effectiveness of marketing strategies.

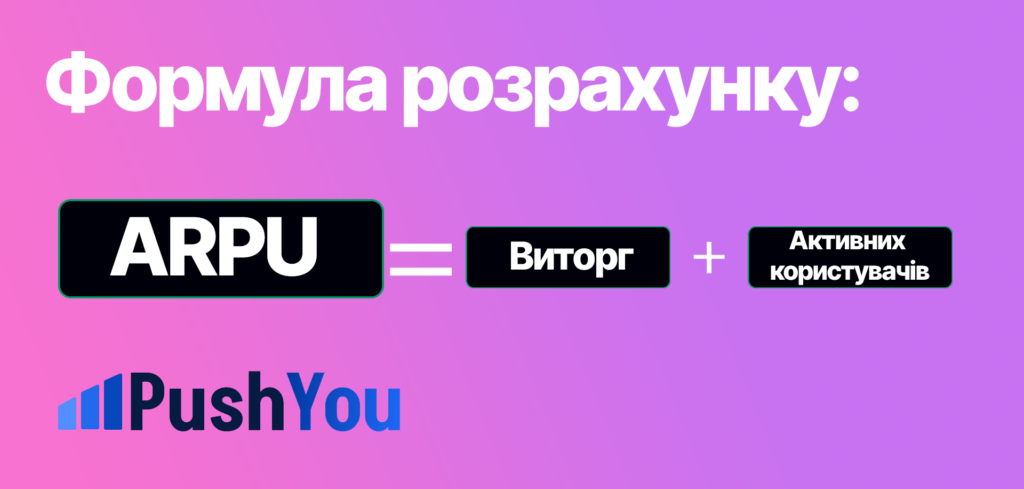

How to calculate ARPU?

To calculate ARPU, you need to divide the total revenue for the selected period by the number of active users for the same period.

ARPU calculation formula

ARPU = Revenue / Number of active users

Similarly, to calculate ARPPU (Average Revenue per Paying User), the same formula is used, but instead of all active users, only paying users are taken into account.

ARPPU calculation formula

ARPPU = Revenue / Number of paying users

ARPPU vs. Revenue / Number of paying users

What the metrics are based on

- ARPU: Based on revenue.

- LTV: Based on gross profit (Gross Profit).

How metrics are calculated

- ARPU: Revenue for the period / Number of active users.

- LTV: Gross profit over the lifetime of the cohort / Number of new users in the cohort.

What questions do metrics answer?

- ARPU: How much revenue an average active user generates per period.

- LTV: How much gross profit the average new user will generate over the lifetime of the product.

Application of ARPU in E-commerce

The ARPU metric is ideal for analyzing established e-commerce solutions with a large and stable audience. It helps to evaluate the effectiveness of website sales automation and understand how different user segments affect the overall revenue.

How to increase ARPU?

- Optimize pricing;

- Implement loyalty programs;

- Use cross-selling;

- Introduce upselling (convincing customers to choose more expensive product options);

- Introduce personalized offers based on customer behavior;

- Introduce a system of limited offers and exclusive products;

- Introduce gamification (bonuses, rewards for activity).

And if you also have a question “how to increase the average check in an online store,” these recommendations will help you improve the average check as well.

How to reduce ARPU for the benefit of the business?

- Attract new customers through channels with lower LTV but high ROI;

- Expand the audience;

- Reduce the minimum threshold for free delivery to encourage more frequent purchases;

- Introduce special promotions or offers for new users.

- Expand the assortment with new products to attract new user segments.

ARPU limitations and why you should use LTV

It is important to remember that ARPU is only one of the indicators, and its use for making product decisions should be cautious. For example, stopping attracting new users can lead to artificial growth of ARPU but harm the long-term development of the business. For a deeper analysis, it is recommended to use LTV, which takes into account the entire value of the customer during his or her interaction with the product.

Conclusion.

ARPU and LTV are different metrics that answer different questions. ARPU is suitable for analyzing monetization efficiency over long periods, while LTV is better suited for product analytics and assessing the long-term value of customers. To increase sales through your website, you need to use both metrics in combination to achieve maximum results. And if you need help with advertising your product or service, you can contact us on Telegram or by phone – +888 888 888 8888.